If you live in one of these 13 states, you could be paying extra taxes on your Social Security

With the average Social Security recipient relying on $1,505.50 a month in Social Security benefits, every penny counts.

And according to The Senior Citizens League, nearly half of all seniors are paying taxes on their benefits.

Since 1984, the federal government has been able to collect taxes on these benefits. But did you know that certain states are tacking on their own taxes as well?

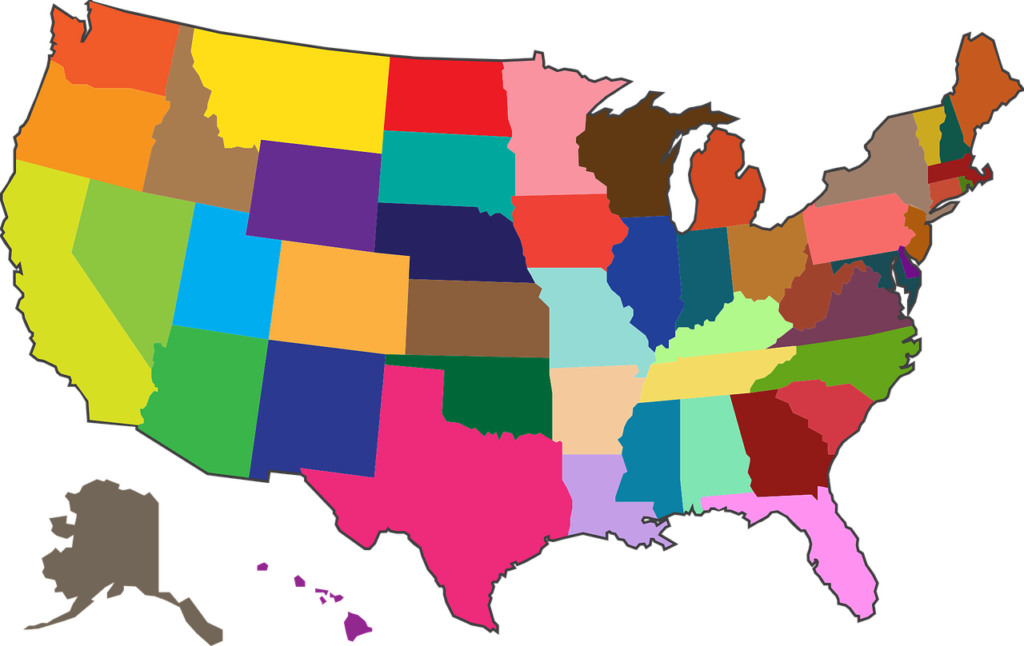

If you live in one of the following 13 states, your state could be taking additional taxes out of your benefit check:

- Colorado

- Connecticut

- Kansas

- Missouri

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

- Utah

- Vermont

- West Virginia

Luckily for residents of West Virginia, WV will be dropping off this list by 2022 and joining the 37 states that do not currently tax Social Security.

To learn more about that states that are collecting taxes on Social Security, and if your benefits are at risk, check out the article below.

[contentcards url=”https://www.usatoday.com/story/money/2020/03/09/social-security-benefit-tax-by-state/111407714/”]