Why Some States Tax Social Security While Others Don’t

Tax Day is coming up. This year the deadline to file federal tax returns is April 18. It’s extended because the traditional April 15 deadline falls on a Saturday and the next weekday is a recognized holiday (Emancipation Day) in Washington D.C.

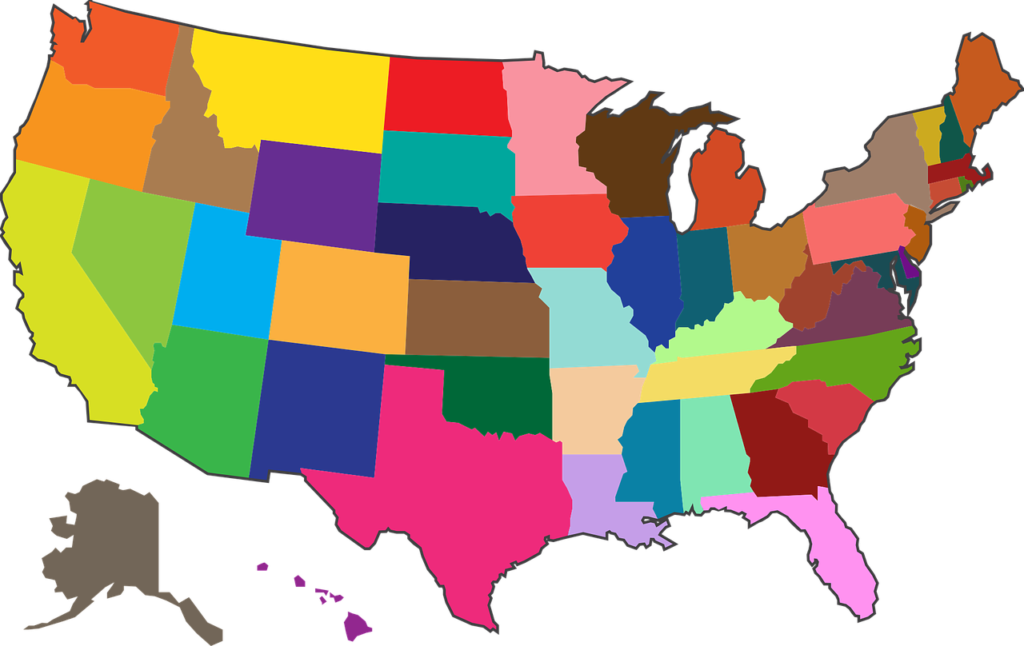

According to an article in USA Today, retirees whose incomes exceed certain amounts have to pay federal taxes on their Social Security income. And for those living in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah and Vermont, your state also wants a portion. These are the only 11 states still collecting tax on Social Security. West Virginia eliminated its state tax, but retirees will still need to pay from 2022 earnings. Missouri lawmakers are considering phasing out their state tax.

The Seniors Trust is committed to improving the financial well-being of America’s retirees through passage of The Social Security Expansion Act. It will give retirees an immediate benefits increase of about $200 a month, a fair annual cost-of-living adjustment (COLA) and increased minimum benefits.