The Time Has Come for Congress to Shore Up Social Security

Time is running out. The Social Security trust fund, from which retiree’s benefit checks are paid, is expected to be depleted by 2035. After that, payroll taxes will only be able to pay about 80 percent of scheduled benefits.

This means the clock is ticking for Congress to take action and do something to shore up Social Security — now!

According to an article by The Motley Fool, with only about a decade left until the trust fund reaches a deficit, it’s becoming increasingly more urgent that politicians stop trying to bury their heads in the sand and take action on this highly divisive and partisan issue.

Enact the Social Security Expansion Act

Lawmakers have introduced three proposals on how to handle the shortfall Social Security is facing. The Seniors Trust believes the Social Security Expansion Act is the most viable.

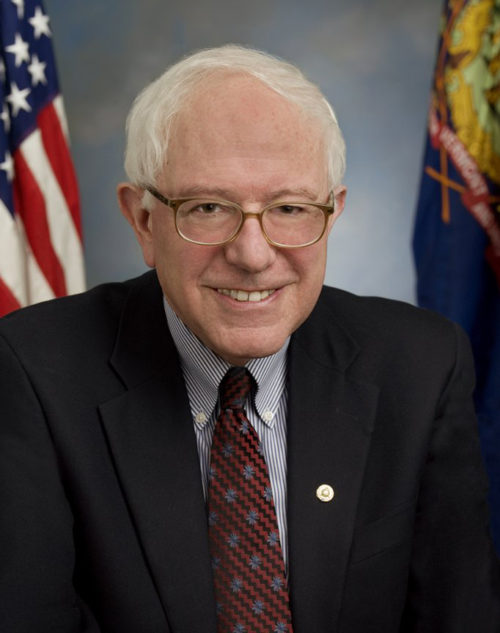

As the article explains, the Social Security Expansion Act, sponsored by Sen. Bernie Sanders (I-Vt.), Sen. Elizabeth Warren (D-Mass.), and House Rep. Peter DeFazio (D-Ore.), “proposes to extend the solvency of the trust funds by 75 years by raising the benefit base to $250,000. The bill also proposes to… require individual millionaires and billionaires to pay a 12.4 percent tax rate, up from the current 6.2 percent individual rate and equivalent to Social Security taxes that self-employed workers currently pay.”

Staving off Social Security insolvency is just one of the bill’s tenets. It’s also focused on improving the financial situation for older Americans.

When enacted, the Social Security Expansion Act will increase benefits for most recipients by about $200 per month. And it would establish a fairer cost-of-living adjustment (COLA) by using the Consumer Price Index for the Elderly (CPI-E) as a calculator instead of the Consumer Price Index for Urban Wage Earners (CPI-W) used currently. The CPI-E takes the unique spending habits of seniors into account — particularly regarding the cost of healthcare — and offers a more realistic COLA for retirees. Lastly, the bill would increase minimum Social Security benefits to provide higher payments to seniors and greatly reduce senior poverty.