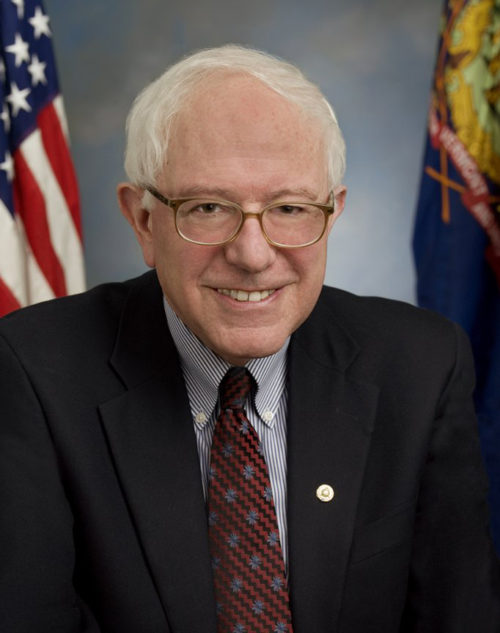

What Sen. Sanders Said About Social Security That Has Corporate America Concerned

Senator Bernie Sanders (I-VT) has been leading the charge to help save Social Security. He is one of the sponsors of the Social Security Expansion Act. If passed, this landmark legislation would extend the solvency of Social Security through 2096 and increase benefits by $2,400 per year for beneficiaries.

That plan all hinges on lifting the income tax cap and applying the Social Security payroll tax to all income above $250,000. Right now, workers only pay Social Security on the first $147,000 of income — anything above that is not taxed. According to Channel3000, Sen. Sanders says that is unfair and needs to change.

He has been quoted as saying: “It is absurd that a billionaire in America today pays the same amount of Social Security taxes as someone making $147,000 a year. It’s time to scrap the cap, expand benefits, and fully fund Social Security.”

The Seniors Trust is in total agreement. Congress needs to enact the Social Security Expansion Act. It’s the best way to secure the long-term solvency of Social Security. By applying the payroll tax on all income — including capital gains — above $250,00 per year, this bill will fully fund Social Security for another 75 years ensuring it’s available for all hardworking American retirees. Join us in our fight to save the Social Security for senior citizens of today, and tomorrow!