Do You Have To Pay Taxes On Your Social Security Income?

By now you have probably received your Social Security Benefit Statement (Form SSA-1099). It lists the benefits you received during the previous tax year and is used to determine if you need to pay federal income tax on your benefits. The majority of Social Security recipients do have to pay taxes on their benefit income.

Investopedia has a great article explaining how to figure out if you need to pay, how much you might owe, and even what you can do to reduce the taxes you pay on benefits in the future. Here are a few key takeaways from reporter Melissa Horton:

- If you have little income other than Social Security you probably don’t earn enough money to be taxed – and might not even need to file a tax return. Be sure to check!

- If you have a gross income including Social Security of at least $25,000, then up to 50% of your Social Security income is taxable. That’s also true for couples filing jointly with a combined gross income of $32,000 or more.

- If your combined gross income is at least $34,000 for an individual, or $44,000 for a couple filing jointly, then up to 85% of Social Security benefits are taxable.

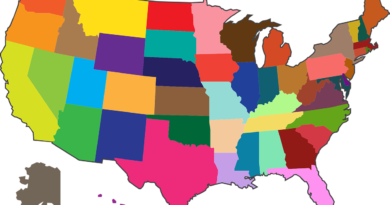

Residents of 13 states also have to pay state tax on their Social Security benefits. These states include Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia.

Although no one wants to pay more in taxes, America’s retirees need and deserve more money from Social Security. The Seniors Trust is working diligently to increase the amount of benefits retirees receive by about $65 each month. This can be accomplished through passage of the Social Security Expansion Act. The landmark bill guarantees the long-term solvency of Social Security and expands benefits for seniors – instead of cutting them.